Home

|

Products

|

9789356962026

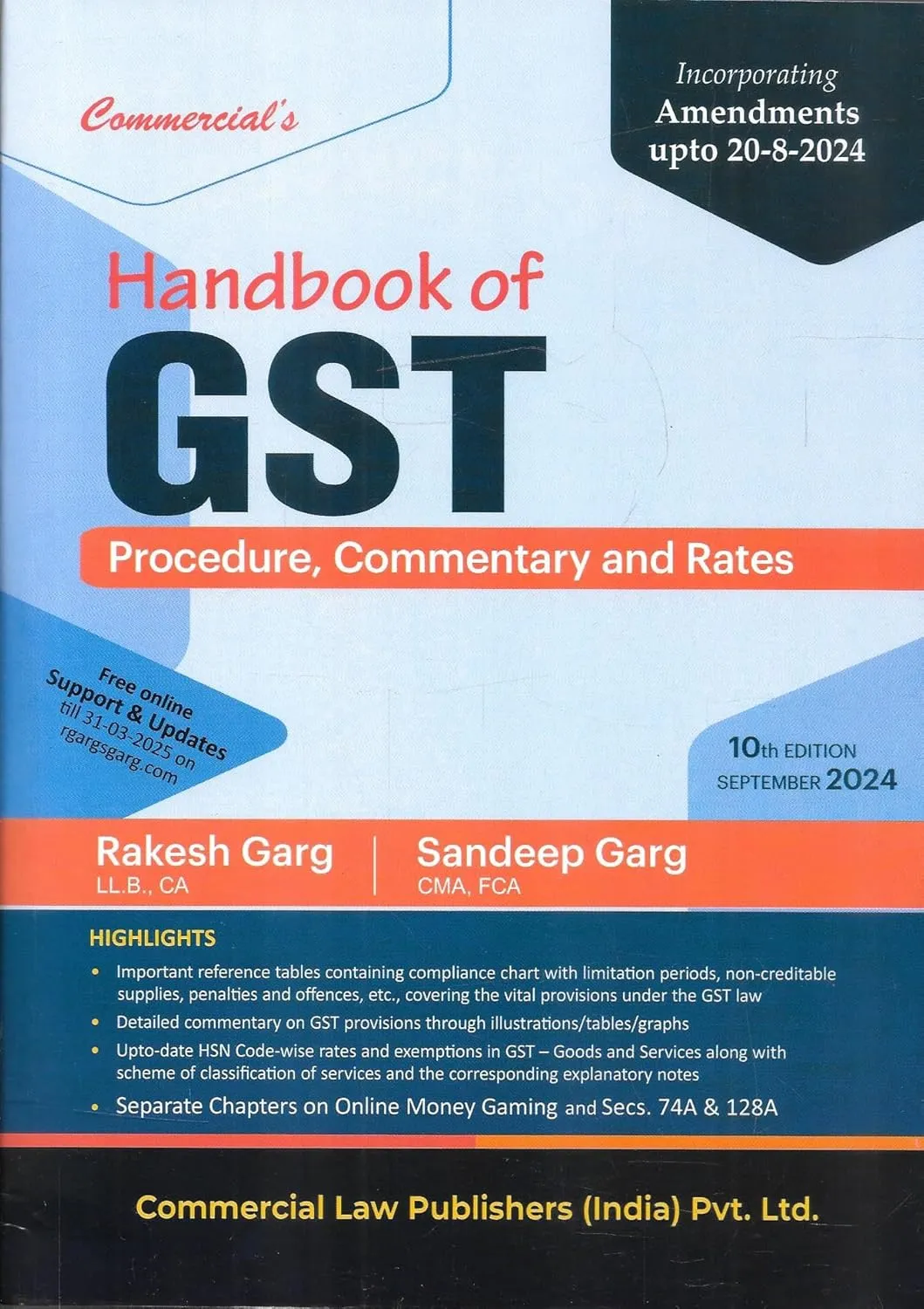

Handbook of GST Procedure, Commentary and Rates 10th Edition

by Rakesh Garg

Highlights

9789356039032

ISBN

Rakesh Garg

Author

1000

Pages

2930 gm

Weight

English

Language

2024

Year

10th Edition

Edition

Paperback

Binding

₹2965

₹3295

The "Handbook of GST" by Commercial Law Publishers is a comprehensive guide to the Goods and Services Tax (GST) law in India. This 10th edition, published in September 2024, incorporates amendments up to 20-8-2024, providing readers with the latest updates. The book offers detailed commentary on GST provisions through illustrations, tables, and graphs, making it an invaluable resource for professionals and students alike. It includes important reference tables covering compliance charts, limitation periods, non-creditable supplies, penalties, and offences under the GST law. Additionally, it provides up-to-date HSN Code-wise rates, exemptions in GST for goods and services, a scheme of classification of services, and corresponding explanatory notes. Separate chapters are dedicated to Online Money Gaming and Sections 74A and 128A, ensuring a thorough understanding of these specific areas. With free online support and updates, this handbook is a must-have for anyone navigating the complexities of GST in India.

Online store of medical books

Discover a comprehensive range of medical books at our online store. From anatomy and physiology to the latest clinical guidelines, we've got you covered.

Trusted by students, educators, and healthcare professionals worldwide. Browse top publishers and expert-authored titles in every medical specialty. Enjoy fast shipping, secure payments, and easy returns. Your one-stop destination for quality medical knowledge at your fingertips.

Whether you're preparing for exams or expanding your clinical expertise, our curated collection ensures you have the right resources at hand. Dive into detailed illustrations, case studies, and up-to-date research that enhance your understanding and practical skills.

We regularly update our inventory to include the latest editions and newly released titles, helping you stay current in the ever-evolving medical field. Our advanced search and filtering tools make finding the perfect book quick and hassle-free.

Join our community of lifelong learners and medical enthusiasts. Sign up for exclusive discounts, early access to new arrivals, and personalized book recommendations tailored to your professional interests.